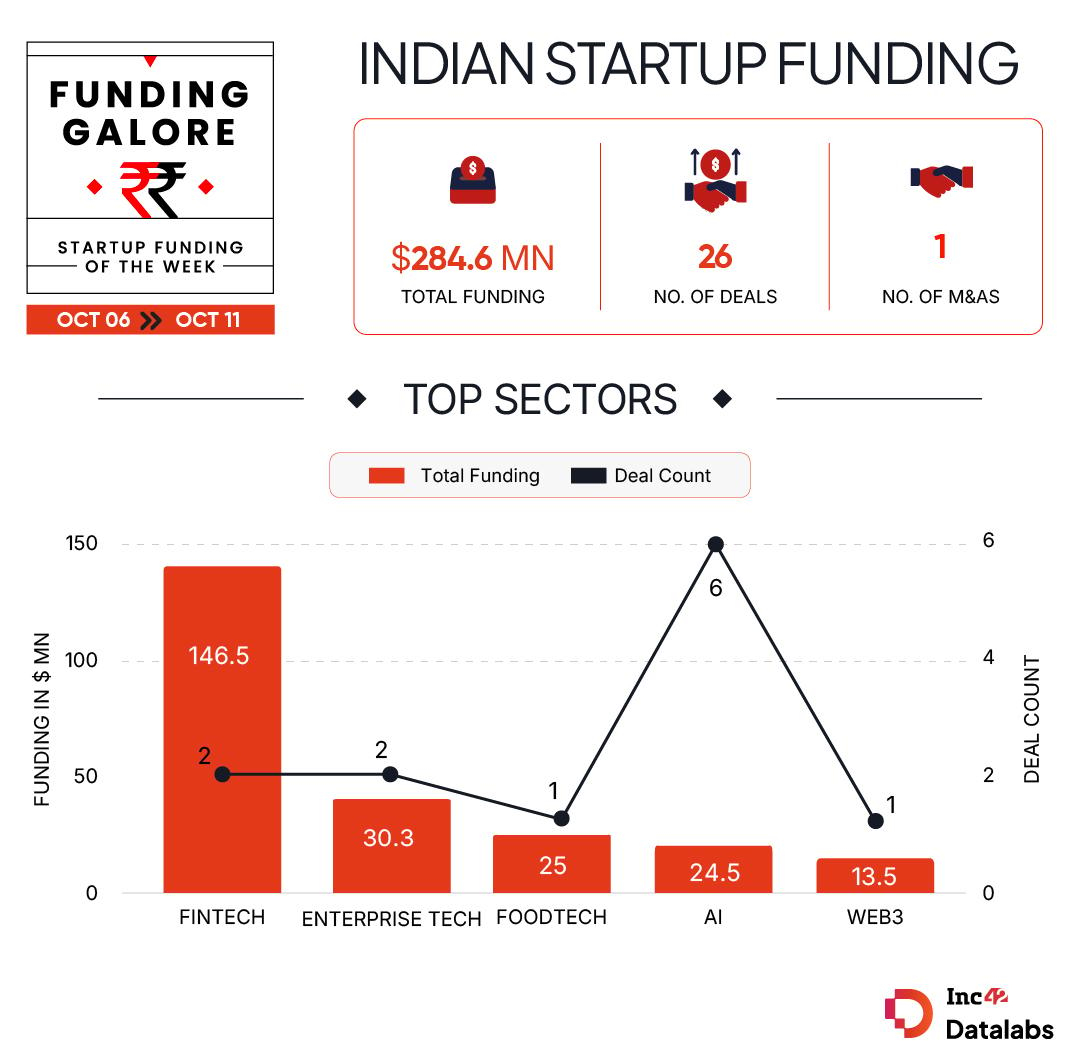

In what was a continuation of the volatility seen in the recent weeks, Indian startup funding surged this week after plunging last week. Twenty six startups raised $284.6 Mn during October 6-11, up 78% from $160.3 Mn raised by 14 startups in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [Oct 6-11]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 6 Oct 2025 | Dhan | Fintech | Investment Tech | B2C | $120 Mn | Series B* | Hornbill Capital, MUFG, BEENEXT, Ramesh Damani (founder, DMart), DSP Family Office, JM Financial Family Office, Aashish Somaiyaa (White Oak Capital) | Hornbill Capital, MUFG |

| 7 Oct 2025 | Intangles | Enterprise Tech | Vertical SaaS | B2B | $30 Mn | Series B | Avataar Venture Partners, Baring Private Equity Partners India, Cactus Partners | Avataar Venture Partners |

| 9 Oct 2025 | Qapita | Fintech | Fintech SaaS | B2B, B2C | $26.5 Mn | Series B | Charles Schwab Corporation, Citi, MassMutual Ventures | Charles Schwab Corporation |

| 10 Oct 2025 | Hunger Inc | Foodtech | Cloud Kitchen | B2C | $25 Mn | – | Lighthouse, DSG Consumer Partners | – |

| 7 Oct 2025 | KGen | Web3 | Blockchain Infrastructure | B2B | $13.5 Mn | – | Prosus, Jump Crypto, Accel | – |

| 9 Oct 2025 | Rusk Media | Media & Entertainment | Digital Media | B2B | $11.6 Mn | Series B | IvyCap Ventures, LC Nueva, InfoEdge Ventures, Woori Venture Partners | IvyCap Ventures |

| 6 Oct 2025 | GreyLabs AI | AI | Application Layer | B2B | $10 Mn | Series A | Elevation Capital, Z47 | Elevation Capital |

| 8 Oct 2025 | Meolaa | Ecommerce | D2C | B2C | $6 Mn | Pre-Series A | General Catalyst, Claypond Capital, Colossa Ventures, Kunal Shah (founder, CRED) | General Catalyst |

| 10 Oct 2025 | FS Life | Ecommerce | D2C | B2C | $5.6 Mn | – | Colossa Ventures, Rahul Garg (founder, IGNITE Growth), Fireside Ventures, Mirabilis Investment Trust | Colossa Ventures |

| 7 Oct 2025 | Lucio | AI | Application Layer | B2B | $5 Mn | Seed | DeVC, Ashish Kacholia (cofounder, Lucky Investment Manager), Lashit Sanghvi (cofounder, Alchemy Capital) | DeVC |

| 7 Oct 2025 | The Medical Travel Company | Travel Tech | Online Travel Agency | B2C | $4.5 Mn | Seed | Nexus Venture Partners, Kriscore Capital, Ben Stokes, Jofra Archer, Stuart Broad, KL Rahul, Sriharsha Majety (cofounder, Swiggy), Abhishek Goyal (cofounder, Tracxn), Ritesh Malik (cofounder, Innov8), Manish Vij (managing partner, Smile Group), Arjun Vaidya (cofounder, V3 Ventures) | Nexus Venture Partners |

| 6 Oct 2025 | Morphing Machines | Advanced Hardware & IoT | Semiconductor | B2B | $4.3 Mn | Series A | IAN Alpha Fund, Speciale Invest, IvyCap Ventures, Navam Capital, Golden Sparrow Ventures, IIMA Ventures, DeVC | IAN Alpha Fund |

| 9 Oct 2025 | Reo.Dev | AI | Application Layer | B2B | $4 Mn | Seed | Heavybit, Foster Ventures, India Quotient | Heavybit |

| 6 Oct 2025 | EcoEx | Cleantech | Climate Tech | B2B | $4 Mn | – | Dovetail Global Fund PCC, Navbharat Investment Fund, Narnolia Velox Fund | Dovetail Global Fund PCC |

| 6 Oct 2025 | OZi | Consumer Services | Quick Commerce | B2C | $3.3 Mn | Seed | Blume Ventures, Huddle Ventures, Zeropearl VC, Untitled | Blume Ventures |

| 7 Oct 2025 | August AI | AI | Application Layer | B2C | $3 Mn | Seed | Accel, Claypond Capital | – |

| 6 Oct 2025 | Navata Supply Chain Solution | Logistics | Shipping & Delivery | B2B | $1.5 Mn | – | Abyro Capital | Abyro Capital |

| 6 Oct 2025 | Finarkein Analytics | AI | Application Layer | B2B | $1.5 Mn* | Pre-Series A | DSP Group Family Office, Capital 2B | DSP Group Family Office |

| 7 Oct 2025 | TrusTerra | Ecommerce | Vertical Marketplace | B2C | $1 Mn | Pre-Seed | Finvolve, India Accelerator, GrowthCap Ventures, Shishir Maheswari (MD, Eversource Capital), Samrath Jit Singh (founder, Trontek Batteries), Ayush Lohia (CEO, Lohia Auto), Kapil Nirmal (angel investor) | Finvolve, India Accelerator |

| 7 Oct 2025 | Contrails AI | AI | Application Layer | B2B | $1 Mn | Pre-Seed | Huddle Ventures, IAN Group | Huddle Ventures, IAN Group |

| 7 Oct 2025 | H2 Carbon Zero | Cleantech | Climate Tech | B2B | $850K | Seed | Venture Catalysts, Faad Networks | Venture Catalysts |

| 7 Oct 2025 | Thrustworks Dynetics | Advanced Hardware & IoT | Space Tech | B2B, B2G | $790K | Seed | Jamwant Venture, Piper Serica, SINE-IIT Bombay | Jamwant Venture |

| 8 Oct 2025 | Newtral | Cleantech | Climate Tech | B2B | $600K | Seed | NOW Venture Studios | NOW Venture Studios |

| 10 Oct 2025 | Ask My Guru | Consumer Services | Astrology Services | B2C | $500K | – | Matrimony.com | Matrimony.com |

| 7 Oct 2025 | ZillOut | Enterprise Tech | Vertical SaaS | B2B | $310K | Seed | Jindagi Live Angel Fund, Anshul Jhawar (cofounder, ZillOut) | – |

| 7 Oct 2025 | Jaagruk Bharat | Consumer Services | Listing & Discovery Services | B2C | $169K | Pre-Seed | AJVC | AJVC |

| *Mix of primary and secondary transactions Source: Inc42 Note: Only disclosed funding rounds have been included |

Dhan became the sixth Indian unicorn of 2025, raising $120 Mn at a valuation of about $1.2 Bn. With Dhan’s unicorn minting round, the fintech sector saw the highest weekly funding at $146.5 Mn across two deals.

Dhan became the sixth Indian unicorn of 2025, raising $120 Mn at a valuation of about $1.2 Bn. With Dhan’s unicorn minting round, the fintech sector saw the highest weekly funding at $146.5 Mn across two deals. - However, AI saw the highest number of weekly funding deals this week. Six AI startups cumulatively raised $24.5 Mn this week.

- Accel, Claypond Capital and DeVC were the most active investors this week, backing two startups each.

- Weekly seed funding stood at $24.6 Mn across 11 deals, a multifold jump from $3.1 Mn raised by four startups at this stage last week.

- While shares of WeWork India made a muted public market debut this week, Zappfresh had a bumper listing on the exchanges.

- Wakefit and Lenskart received SEBI’s nod this week for their public issues. While Wakefit’s proposed IPO will comprise a fresh issue of up to INR 468 Cr and an OFS component of up to 5.8 Cr equity shares, Lenskart’s IPO will comprise a fresh issue of up to INR 2,150 Cr and an OFS of up to 13.2 Cr shares.

- Early stage-focussed VC firm Theia Ventures announced the first close of its maiden fund with a target corpus of $30 Mn.

- Fintech-focussed VC firm Aagama Ventures launched INR 400 Cr (around $45 Mn) fund to back early stage startups. The VC firm plans to invest in 15 to 20 fintech startups via the fund.

- Jamwant Ventures, in partnership with Aavishkaar Group, launched its second fund, Jamwant Ventures Fund 2, with a target corpus of INR 500 Cr (about $60 Mn).

- Troubled alcobev startup Bira 91 is looking to raise $100 Mn(INR 888.5 Cr) in a mix of equity and debt to pay over dues, invest in working capital and capital investments for growth of the company’s business.

- Listed travel tech major ixigo is raising INR 1,296 Cr (around $145.9 Mn) from Prosus through a preferential issue on a private placement basis to fuel its growth.

- IPO-bound Groww completed the acquisition of Fisdom after receiving SEBI’s approval. With this, the company is looking to launch its HNI focussed offering ‘W’.

The post From Dhan To Intangles — Indian Startups Raised $285 Mn This Week appeared first on Inc42 Media.

You may also like

Strictly Come Dancing fans make same complaint minutes into Movie Week madness

Mary Berry says sponge cake will taste 'perfect' if you swap butter for 1 ingredient

Keely Hodgkinson bounces back from 's***show' with five-figure payday and diamond tiara

New US Ambassador hails 'new era' in US-India relations driven by PM Modi and Trump

Trumpelmann, Green Guide Namibia To Historic Win Over South Africa